The Dictionary of Sydney was archived in 2021.

Australia’s First Lottery

Citation

Persistent URL for this entry

To cite this entry in text

To cite this entry in a Wikipedia footnote citation

To cite this entry as a Wikipedia External link

Australia's first lottery, held in Sydney in 1849, was surrounded by controversy and was probably illegal. It was immensely popular however and the government turned a blind eye as it seemed the only way of averting the consequences of a financial disaster.

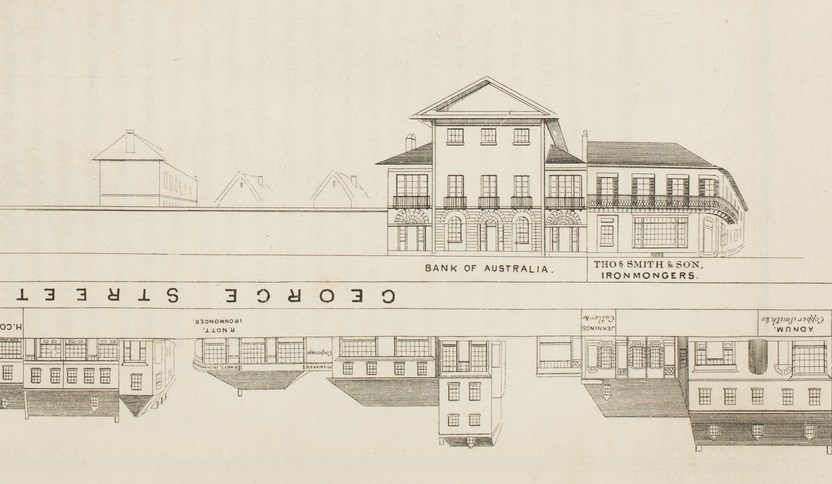

The 1840s Depression and the Bank of Australia

[media]The disaster was the virtual collapse of the economy of the colony of New South Wales in the early 1840s. While New South Wales received Britain's convicts the British government paid, in addition to their direct costs, a subsidy to develop the colony's infrastructure of public buildings, roads and the like. With the cessation of transportation in 1840 these subsidies were largely withdrawn, causing a general scarcity of money and putting a severe brake on public works resulting in widespread unemployment. Farmers, in particular, also relied on the unpaid labour of the convicts assigned to them and the loss of this free labour, exacerbated by a prolonged drought, caused many farms to become unprofitable.

During the 1830s there had been excessive speculation in newly-opened lands, fuelled by the willingness of the banks to lend to speculators on the basis of highly inflated values and these disruptions punctured the land speculation balloon. When land values collapsed and mortgage payments could not be made, many borrowers were ruined and the banks came into possession of thousands of properties that had been offered as collateral security that, it turned out, were both unproductive and virtually unsaleable. The banks thus found themselves in difficulties with inadequate assets to cover deposits and other liabilities and in early March 1843 one of the Colony's major financial institutions, the Bank of Australia, collapsed.

Not only had the 180 or so shareholders of the Bank of Australia lost their investment, but, unless a way was found to cover the bank's debts, they faced personal ruin as their liability was unlimited. The bank's debts were estimated at about £225,000 and its assets were primarily in surrendered real estate which was now worth very little. But the shareholders' assets were also mostly real estate and there was therefore little likelihood that shareholders could raise sufficient funds to cover their liabilities. The ruin of so many individuals would only increase the damage to the economy and create a general panic.

Dividing the Assets

The bank's directors decided that there must be a levy upon all shareholders, and that in order to assist them to meet this levy the assets of the bank should be divided amongst them. Perhaps they could sell the assets individually, instead of the bank holding a mass sale which would depress prices overall, or they might prefer to hold on to the property they received in the hope that values would eventually rise. The bank's real estate holdings were very numerous and diverse, from large farms and prominent city buildings to small, unproductive and almost valueless allotments in distant country areas. The directors considered how best to divide up these assets among shareholders in an equitable manner, and concluded that distributing them by lot was the only way which would ensure fairness and impartiality. Such a lottery, in which the prizes would be the estates foreclosed for debts unpaid, was a novel scheme for getting rid of the bank’s burden of debt by transferring these properties to its shareholders who would then be responsible for trying to sell them so as to meet their obligations.[1]

The Lottery Scheme

Some of the properties turned out, on investigation, to be encumbered or to have some defect or uncertainty in their titles, but 11,248 pieces of real estate were identified as available for distribution immediately. A scheme was devised by which the assets would be numbered from 1 to 11,248. The same number of tickets would be printed, and issued to shareholders in proportion to their shareholdings. Then a drawing would take place at which each ticket would be matched with one of the bank's assets. As a private arrangement among the shareholders such a scheme was not a public lottery (which were outlawed in Great Britain at the time, and therefore probably illegal in New South Wales). However, because some shareholders expressed dissatisfaction at the likelihood of their being awarded a relatively worthless piece of land, it was proposed that any shareholder who did not wish to participate could sell his ticket to a third party. This made the scheme more like a public lottery and it was felt that legislative sanction would be advisable.

Legislative Sanction

Several of the shareholders and directors of the bank were, fortuitously, also members of the Legislative Council and in 1844 the directors drafted a Bill which would relieve the shareholders of their liability and empower the bank to dispose of its real estate assets by lot. WC Wentworth, a major shareholder, introduced the Bill into the Legislative Council in October 1844 and after some moral, religious and legal debate, it was passed in December.[2]

Governor Sir George Gipps caused widespread consternation when, following legal advice, he reluctantly declined to give the Royal assent to the Bill on the grounds that as lotteries were proscribed in Great Britain the Legislative Council of NSW probably lacked the power to authorise them in the Colony. He referred the Bill to London for decision by the Queen. In doing so Gipps made it clear that, though he personally disapproved of lotteries, the paramount consideration for the good of the Colony should be the settlement of the affairs of the bank ‘by almost any means’. The Bill had been passed by ‘a great majority’, and ‘the disappointment is great, which has been caused by my reservation of it.’ He concluded his report by saying ‘it would give me much pleasure could the Bill be allowed by Her Majesty, though I can scarcely venture to hope that it can be.’[3]

Gipps's despatch to London was accompanied by a petition to the Queen from the chairman and directors of the bank, setting out their reasons why the Bill should be allowed. Essentially, they argued that settlement of the bank's affairs would greatly relieve the present economic depression in the Colony, the state of the markets made it impossible for the bank's assets to be disposed of by sale, and the proposed lottery was the only effective means of resolving the situation and restoring value to the economy.

These appeals were in vain. The British government advised the Queen against giving the Royal assent to the Bill on the grounds that, however worthy the cause, ‘public Lotteries are regarded with the highest disfavour by Parliament and by public opinion in this Country ....’ It was also noted that, as several of the shareholders who would benefit from the Bill were also members of the Legislative Council, there could be some doubt ‘whether the measure was adopted with a due amount of vigilance and circumspection.’[4]

The normal delays in getting decisions from Britain were compounded by a court case brought by some directors claiming that they were not responsible for certain loans made by the bank. Things dragged on until June 1848 when the Privy Council’s ruling, made in England in February, that the bank’s shareholders were indeed liable for its debts was received, and the awful spectre of widespread calamity was revived.[5]

The Lottery Goes Ahead

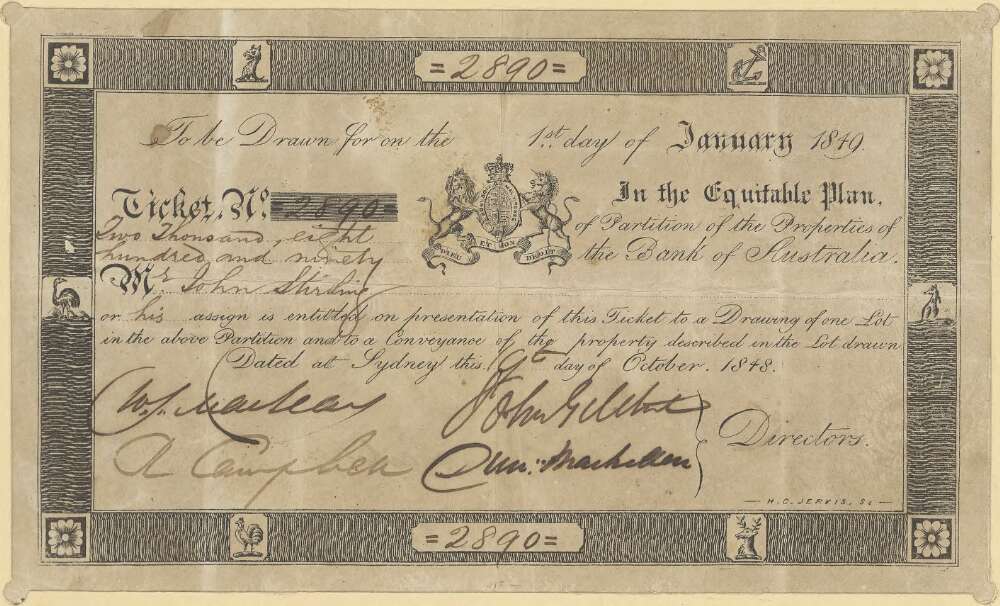

[media]The situation required a desperate remedy, and the directors confirmed their decision that the fairest way of relieving shareholders' liability and disposing of the bank's property assets was the lottery scheme. They resolved to proceed without formal legal sanction on the grounds that even though their Bill had been rejected by London there was no law of the local legislature expressly forbidding a lottery. Accordingly, in October 1848 11,248 tickets were printed, numbered, signed by four directors, and issued to the shareholders in proportion to their shareholdings.[6]

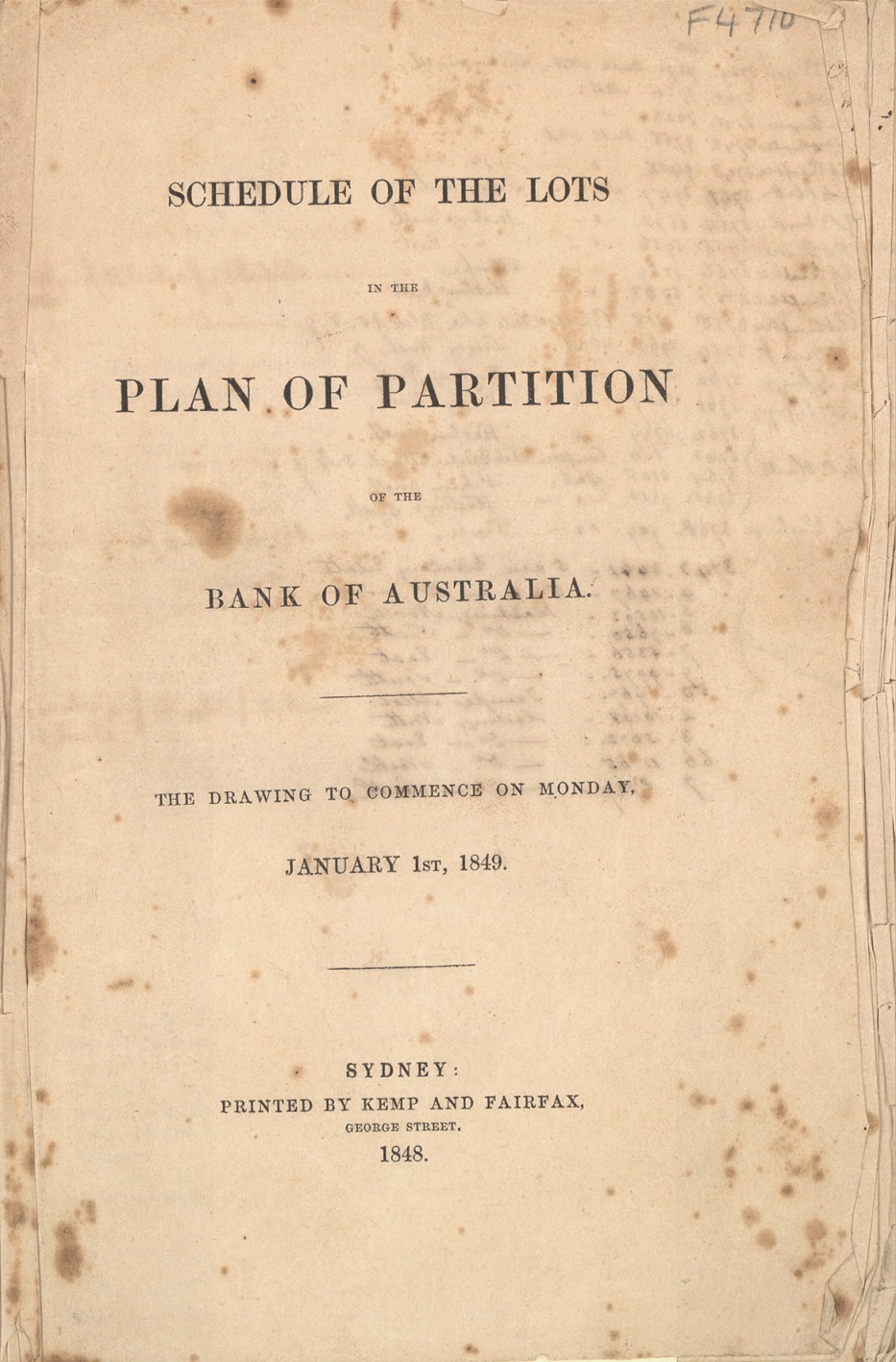

[media]The bank published a list of the prizes.[7] The most valuable prize, said to be worth £6,000, was a farm of 8,320 acres (3,367 hectares), including a house, barns, vineyards, orchards, 3,700 head of cattle, etc. in the Dungog-Barrington Tops district, north of Newcastle, plus another farm on the Liverpool Plains. Second most valuable, at £3,000, was a parcel of several public houses and cottages in inner Sydney plus a public house and two acres of land at Woolloomooloo, plus a farm on the Nepean River and other smaller properties. Third, at £1,500, was ‘The Normal Institution, Elizabeth street Sydney fronting Hyde Park’ plus a house and other items.

[media]Other prizes included houses, shops and pubs in Sydney and suburbs and country towns, including many housing allotments presumably forfeited by bankrupt developers. For example, there were about 200 subdivided allotments and a further 20 acres in the exotically named ‘Bello Retiro’ Estate in Newtown. There were similar bankrupt subdivisions at Lane Cove and Tempe and along Bourke St Surry Hills, to name only a few. There were 700 acres of land at Kiama, other large holdings at Maitland, Wollongong, Gosford, Camden and Yass, and elsewhere. It was an enormous portfolio of property, some of it very valuable but the great majority were small country allotments said to be valued at about £4 each. Because property prices were severely depressed these valuations were approximate only, but a small number of undoubtedly valuable properties were available, along with a very large number of properties in distant parts of the country. Small, frequently poorly subdivided and difficult to identify, these proved to be almost worthless, at least in the short term.

Many shareholders sold their tickets because they preferred ready money to the very small chance of winning one of the more valuable prizes. The assignment value was set at £4 per ticket and numerous advertisements appeared in newspapers offering tickets for sale.[8]

The lottery was a great novelty and caused much excitement. Nothing like it had ever been experienced before, and the prospect of obtaining a valuable property for only £4 caught the popular imagination[9] with tickets selling as far afield as Tasmania.[10] Every ticket won a prize – it seemed to be a lottery in which one could not lose.

Despite the fact that the Bill authorising it had been disallowed by the British government several years earlier, the local authorities appear not to have taken any action to stop it. A new Governor, Sir Charles FitzRoy, had assumed office and his view of lotteries may have been more tolerant. In any case, public opinion was certainly on the side of the lottery and there was very keen interest. As Butlin put it, the government ‘averted its gaze discreetly while the Australia mess was being cleaned up’.[11]

The Drawing

The drawing of the prizes was set for January 1st, 1849 at the City Theatre in Market Street. It was a complicated affair and took three days to complete. Two wheels were used. The first wheel was the ‘ticket wheel’ and a ticket number was drawn. That ticket would then be awarded the prize indicated by the ‘lot wheel’.[12] This process generated twice the usual suspense – will my ticket be the next drawn? And if it was, what will my ticket win? The audience was in a constant state of excitement.

The Sydney Morning Herald reported

‘Who that saw them can ever forget the rows upon rows of anxious purchasers of tickets, male and female, daily and all day long crowded in the pit and boxes of the City Theatre? Who can ever forget the eager looks, the patient and sustained listening to the announcement of the numbers of the tickets as drawn, the uncompromising suppression of an occasional child -- for even crying infants in arms were carried by their amiable mothers to the lottery -- the hard breathing, and the excitement amongst the shoes, whenever something considered a prize was drawn, the almost audible groan of the old woman as a Fitz Roy fell to her and she was led out (by her friends,) depressed and sunk ...’ [13]

After the drawing the Herald published a full numerical list of the prizes won,[14] which could be matched against the bank's published list of prizes.[15]

The Result

Ticket 3374, which won the first prize, the large farming properties near Dungog and on the Liverpool Plains valued at £6,000, was held by a six-year-old boy named Angus McDonald. One of the children of a Scottish farm labourer living near Maitland, his father had bought several tickets and had given one to each of his children. The father assumed ownership of the prize properties as guardian for his son until the boy turned 21. This would have changed his life. A labourer on someone else’s farm, now managing, effectively owning, two large and prosperous farms, all for £4! Unfortunately Mr McDonald didn’t live to enjoy his triumph. Three months later he was killed by falling from his horse and his widow had to apply to the court to become the boy’s guardian and run the farms on his behalf.[16]

Most other ticket holders were not as fortunate. By one estimate there were about two hundred properties offered which could be considered valuable,[17] but the rest were small allotments of ‘worthless scrub, inhabited by snakes, hundreds of miles in the interior, where they are likely to remain unclaimed for a century to come.’[18] Some winners subsequently offered their winning tickets for sale ‘at a reasonable price’ (presumably less than the original price of £4) or ‘to be sold cheap’ rather than take possession of their properties.[19] Some winners banded together, pooled their tickets and raffled them, the winner to take the lot.[20]

Surviving Tickets

Remarkably, it seems that perhaps 1,450 of the 11,248 tickets issued have survived in archives and collections. The National Library of Australia’s catalogue shows 13 tickets. The Mitchell Library catalogue shows 23 tickets are held in the State Library of New South Wales individually as well as another approximately 1,400 cancelled tickets in its collection of Bank of Australia Records.[21] The University of Sydney Library also has one [22] while another two are known to be in a private collection.

Subsequent Lottery Proposals

After the success of the first venture, two other lotteries were proposed in 1849. Because some of the bank’s surrendered mortgage properties were thought to be encumbered or to have some defect or uncertainty in their titles, they had been held back from the first lottery but on further investigation 5,624 of them were found to be legitimately available for distribution and the bank arranged a second lottery to be drawn in April 1849.[23]

At the same time WC Wentworth, a major shareholder in the bank who was liable for a substantial contribution towards the clearance of its debts, decided to use the same means in order to dispose of some of his surplus properties which otherwise he would have had difficulty selling given the depressed state of the market. He advertised tickets for sale at £5 each in a lottery offering 12,000 properties in Sydney and elsewhere, claimed to be valued at £90,000 in total, to be drawn in July 1849.[24]

The legality of lotteries, particularly Wentworth’s which would be for his personal benefit, was argued in the press and within the government. The government warned the bank to defer its drawing until a decision could be taken, and subsequently the Attorney-General informed both the bank and Mr Wentworth that if their lotteries went ahead they would be considered illegal and action would be taken against them.[25] Both were cancelled and the ticket buyers money returned.

It wasn’t until 1930 that the NSW Parliament passed a law allowing lotteries in the State.

Notes

[1] S J Butlin. Foundations of the Australian Monetary System 1788-1851. Melbourne: Melbourne University Press, 1953, 349-54.

[2] LEGISLATIVE COUNCIL.The Sydney Morning Herald, 24 December 1844, p 2 http://nla.gov.au/nla.news-article12419135

[3] Sir George Gipps despatch to Lord Stanley, 1 January 1845. Historical Records of Australia, Series 1, Vol.24, 164-7.

[4] Lord Stanley despatch to Sir George Gipps, 17 May, 1845. Historical Records of Australia, Series 1, Vol.24, 350-1.

[5] LAW INTELLIGENCE., Sydney Morning Herald, 23 June 1848 p2 http://nla.gov.au/nla.news-article12913854

[6] SOMETHING NEW, The Sydney Morning Herald, 19 October 1848, p2 http://nla.gov.au/nla.news-article12907728

[7] Bank of Australia. Schedule of the Lots in the Plan of Partition of the Bank of Australia.... Sydney: Kemp & Fairfax, 1848, (Ferguson 4710)

[8] For example, Sydney Morning Herald, 13 November 1848, p1. Four pounds in 1848 would be equivalent approximately to $1,000 in 2017, Measuring Worth website https://www.measuringworth.com/australiacompare viewed 1 December 2017

[9] The Sydney Morning Herald, 4 November 1848, p 2 http://nla.gov.au/nla.news-article12913975

[10] MULTUM IN PARVO, The Sydney Morning Herald, 30 November 1848, p2 http://nla.gov.au/nla.news-article12912212

[11] S J Butlin. Foundations of the Australian Monetary System 1788-1851. Melbourne: Melbourne University Press, 1953, 354.

[12] Bank of Australia. Schedule of the Lots in the Plan of Partition of the Bank of Australia.... Sydney: Kemp & Fairfax, 1848, pp.iii-iv, National Library of Australia (Ferguson 4710)

[13] Another Lottery Scheme. Sydney Morning Herald, 22 January 1849, p2 A 'Fitz Roy' was current slang for something worthless and contemptible, an allusion to scandalous behaviour by the Governor and his sons.

[14] Bank of Australia. Result of the Drawing of the Lots ... Sydney Morning Herald, 6, 8, 9, 10, 11, 12 January, 1849.

[15] Bank of Australia. Schedule of the Lots in the Plan of Partition of the Bank of Australia.... Sydney: Kemp & Fairfax, 1848. (Ferguson 4710)

[16] Maitland Quarter Sessions. Fatal Accident. Maitland Mercury, 7 April 1849, p2

[17] Original Correspondence. Sydney Morning Herald, 19 February 1849, p3

[18] Original Correspondence. Equitable Partition of Property by Lot. Sydney Morning Herald, 7 February 1849, p3

[19] For example, Bell’s Life in Sydney, 3 February 1849, p4; Sydney Morning Herald, 10 February 1849, p3

[20] For example, Multum in Parvo. Sydney Morning Herald, 19 May 1849, p.2; Hunter River District News: Singleton, The Maitland Mercury and Hunter River General Advertiser, 28 February 1849, p2

[21] Bank of Australia Records, Mitchell Library, State Library of New South Wales ML MSS 1591 Boxes 9 & 10

[22] Rare Books & Special Collections, Fisher Library, University of Sydney F4710PAM

[23] For example, Second and Final Drawing in the Partition of the Bank of Australia Properties. Sydney Morning Herald, 1 February 1849, p1

[24] Sydney Morning Herald, 10 February 1849, p.1; 16 February 1849, p1

[25] The Lotteries. Sydney Morning Herald, 21 April 1849, p3; Mr Wentworth’s Lottery. Sydney Morning Herald, 31 March 1849, p3